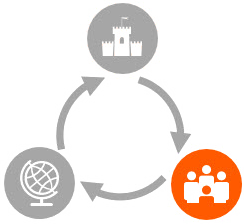

Your Counterparts: Prevent and Detect

It is vital to manage security risks in your interactions and relationships with counterparties, those risks fall into two main categories:

-

If you are breached

-

If your counterparty is breached

If you are breached

Strong detection measures need to be put in place to increase the chances of stopping or mitigating fraud in case your environment is breached. The Payments Controls Service (PCS) brings additional safeguards and ensures that payment instructions are in line with business expectations. PCS makes it easy to mitigate fraudulent attacks by detecting, preventing high-risk payments, and supporting recovery. It combines real-time monitoring, alerting and blocking of suspicious outgoing payments with independent daily reporting.

Daily Validation Reports are part of PCS, designed to support smaller institutions in particular, and launched to provide users with daily activity reports that furnish an independent record of user’s transaction data over Swift. These reports offer both a secondary check on transactions to help prevent and detect fraud and a focused review of large or unusual flows. The reports are available as an independent, Swift-generated source of transaction data that can be reconciled with local transaction data to help in detecting whether a Swift user’s environment has been compromised and their local records altered.

If your counterparty is breached

You also need to prepare for the case that one of your counterparties is breached, and that you may receive suspicious or fraudulent messages from that counterparty.

A starting point is to check that you are only doing business with trusted counterparties. Swift’s Relationship Management Application (RMA) supports users by enabling them to control counterparty relationships through RMA tools, providing a first line of defense against fraudulent transactions.

Log in to the CSP applications and portals

Find the dedicated login links to KYC-SA application, Attestation support page and ISAC portal