What impact will the European Commission’s Instant Payment Regulation have on SMEs trading across Europe? To find out, we spoke to over 2,000 across France, Germany, Italy, and Spain. Here’s what they said.

Within the world of banking and financial services, one market is catching a lot of attention. Across global events, seminars and webinars, the low-value payments sector has firmly stepped into the limelight, as volumes boom and providers pivot to offer consumers and SMEs the best experience possible.

This extra attention isn’t just from the financial institutions processing payments. A market estimated to be worth nearly $12tn, the European Commission also understands the need to optimise the way payments of this nature flow within the continent, having passed a new regulation mandating that payment service providers offer their customers an enhanced experience.

Titled the Instant Payments Regulation, this move looks to improve the speed, security and cost of instant low-value payments within the Single European Payment Area (SEPA). The details of the regulation are:

- Instant payments: All institutions in scope will need to be able to send and receive instant payments.

- Fairly priced: Instant payments in euros must be offered to customers at the same cost as standard transfers.

- Verification of Payee: Institutions must confirm that the name on the payment matches that of the beneficiary account via a Verification of Payee service.

- Advanced screening: Banks and other payment service providers will need to check whether any of their customers are sanctioned persons or entities on a daily basis.

Instant credit transfers across Europe account for less than 13% of the total, but this regulation aims to improve that – changing the way payments travel between countries within Europe, as well as serving as a good example of how other continents can do the same.

What the Instant Payments Regulation means for SMEs

To better understand how these changes will impact those living and working within Europe, we asked over 2,000 SMEs across France, Germany, Italy, and Spain.

All our respondents were senior decision makers within their business and regularly make cross-border payments throughout Europe. Businesses within our sample spanned a range of sizes and sectors, including private, public and professional services, as well as infrastructure, and goods production and distribution.

We’ve summarised our key findings below.

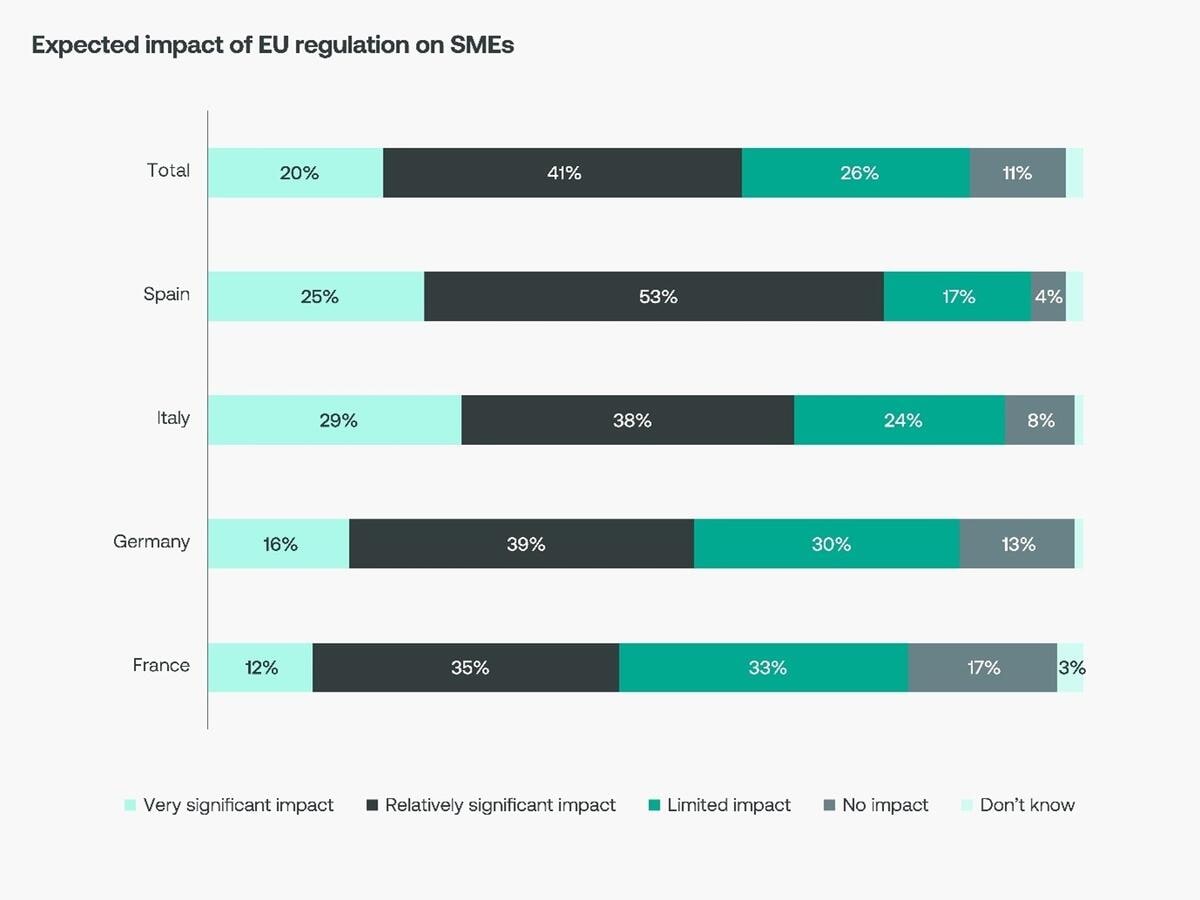

This regulation is expected to have a big impact on SMEs

We asked SMEs whether they expected this regulation to have an impact on their business, and overwhelmingly, almost 90% said it would. 20% said it would have a very significant impact while 41% that it would have a relatively significant impact.

These results speak to the importance of this regulation for those trading between European countries, indicating that the European Commission has hit a sweet spot with how they propose to transform the system currently in place.

Instant is becoming the new normal – regardless of the complexity involved in delivering it – and cross-border payments are no exception. These businesses don’t just want instant payments for the sake of it either – the benefits of being able to send and receive money within the blink of an eye are real and tangible. By doing so, suppliers can ship goods sooner, while buyers have more time to pay their invoices, reducing delays and helping business flow.

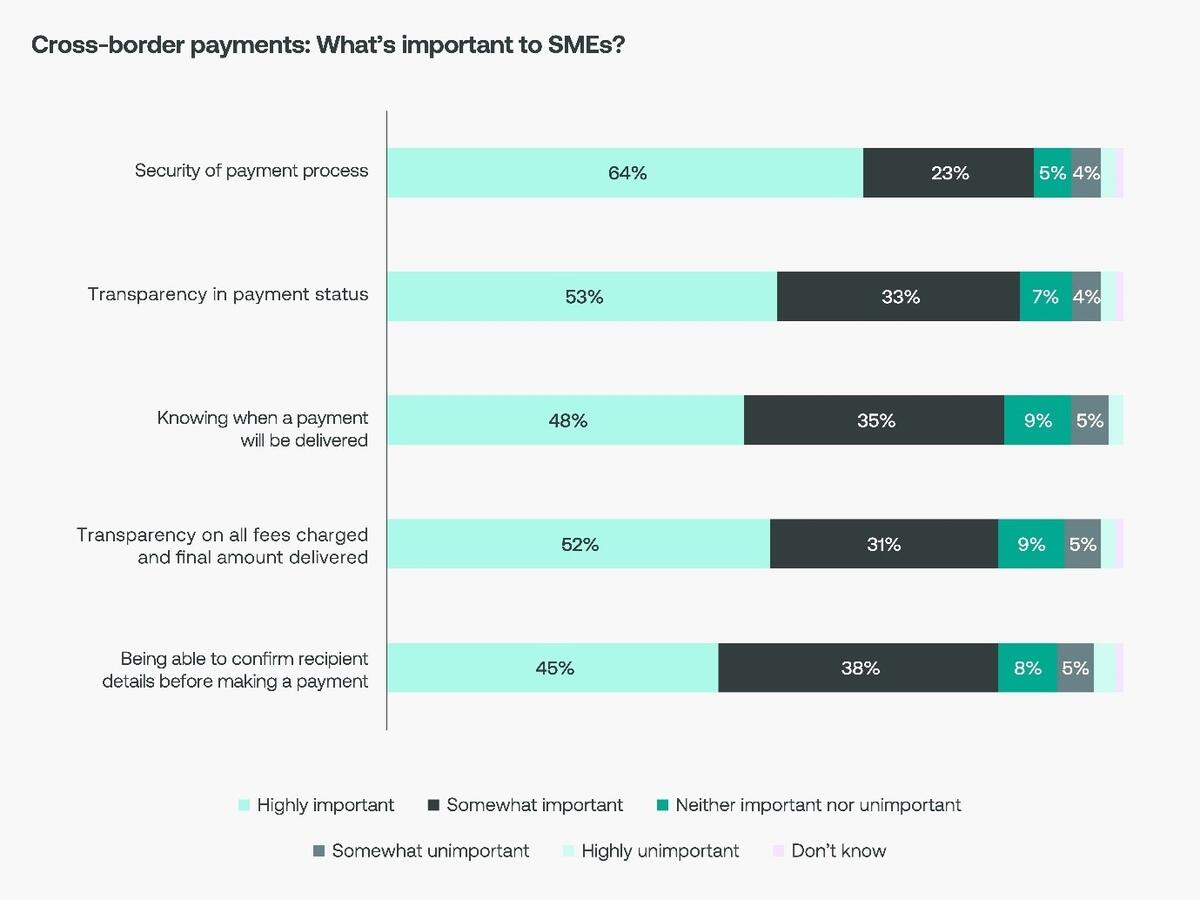

Over 80% of SMEs say confirming recipient details upfront is important

SMEs work hard to turn a profit – often made up of small teams and dedicated individuals. As well as trusting that the institutions and infrastructure processing their payments have secure practices in place, businesses also want peace of mind that their money will arrive in the intended account.

Confirming that the recipient details are correct before hitting send – known as Verification of Payee – is a reliable and efficient way of adding security to the overall process. And 83% of our sample ranked being able to complete a check like this important, with 45% ranking it as highly important.

Verification of Payee also helps identify instances of automated push payment fraud – a type of scam when fraudsters trick people into sending them money by posing as a person or institution they know. Payers would be notified if the recipient name does not match the one on the account, preventing them from falling victim and losing their funds.

Countries across Europe have developed domestic Verification of Payee schemes to varying degrees, but there’s a clear need for a pan-European solution that helps these systems interoperate so they can work internationally too.

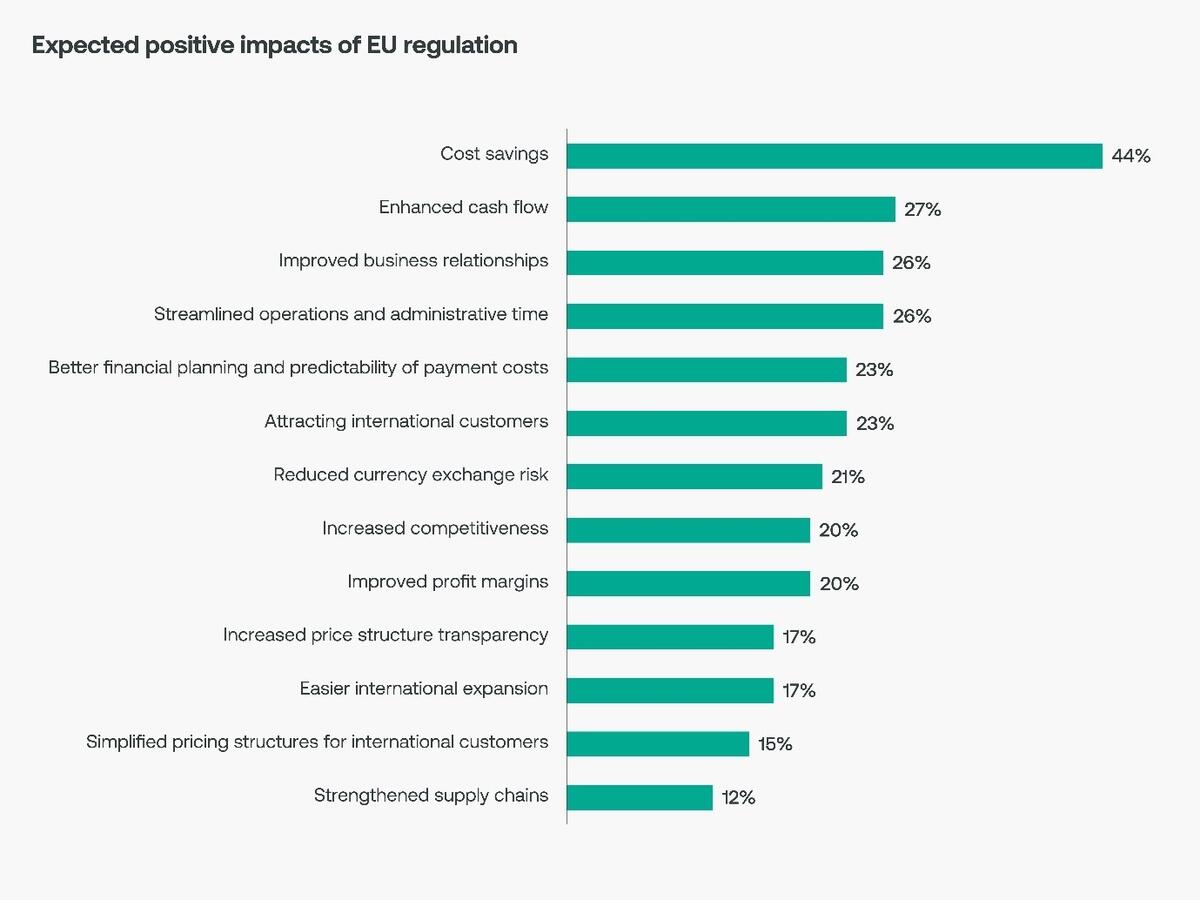

44% of SMEs believe this regulation will reduce their costs

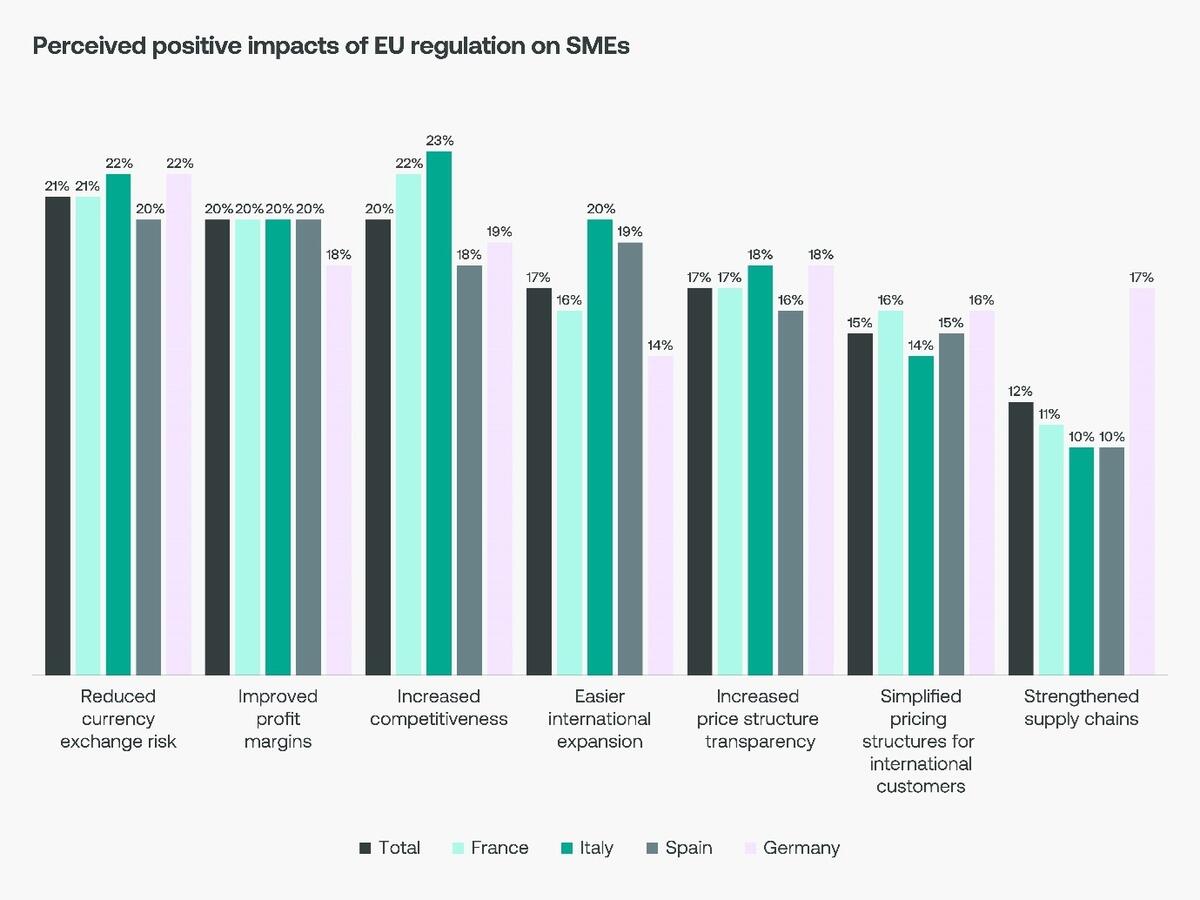

Businesses have an optimistic outlook on the impact this regulation will have on their operations, highlighting cost savings, enhanced cash flow, and improved business relationships as the top three anticipated benefits following its introduction.

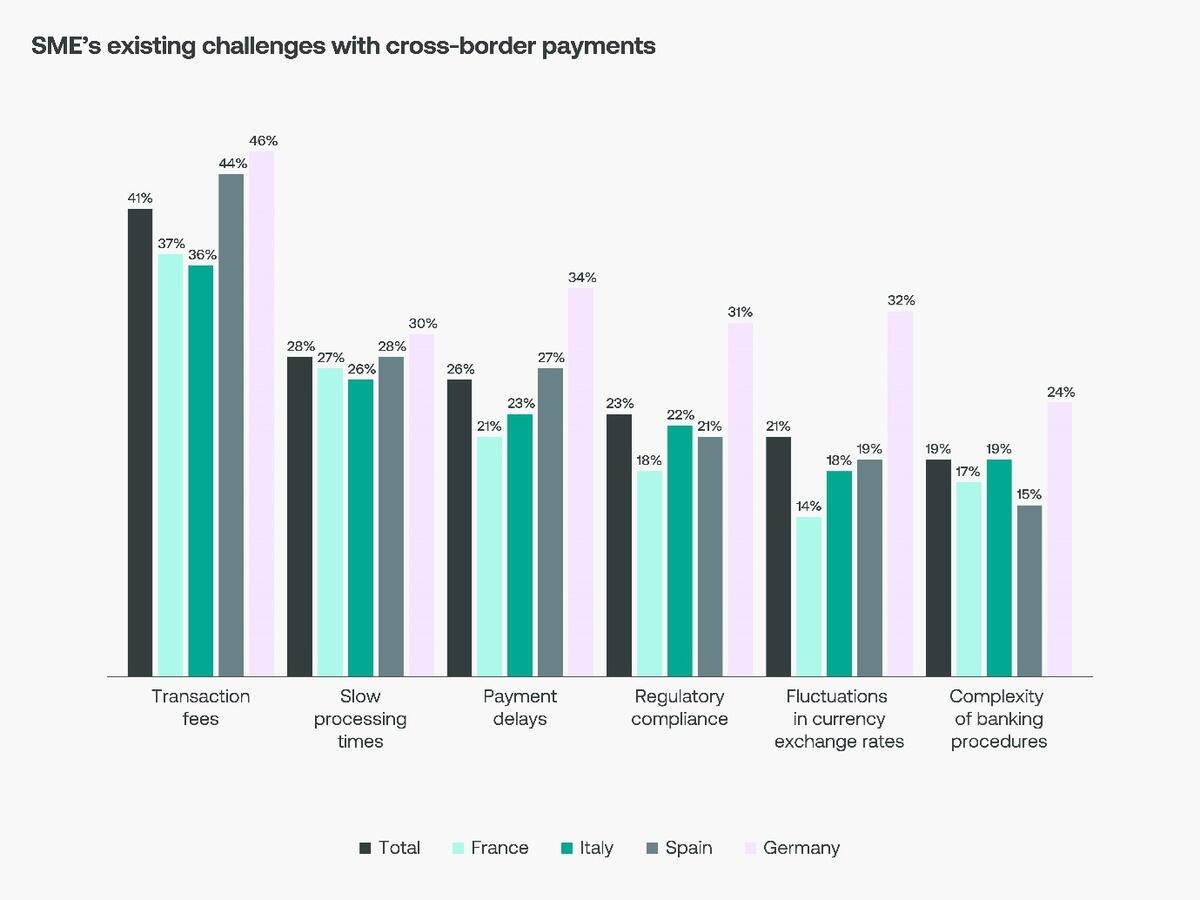

Naturally, these responses suggest that SMEs are eager to invest cash into their growth rather than on obligatory fees. At a time when costs are rising and cash flow is tight, this is expected. Respondents went on to say that challenges with fees are the largest issue they currently face when making international payments, with participants from Spain and Germany voicing particular concerns.

It’s not a coincidence that cost is a primary focus within the EU’s regulation, mandating that payment providers price instant and non-instant transfers equally to help alleviate these pain paints.

One in five think the regulation will make their business more competitive

20% of respondents told us that the regulation would make their business more competitive, potentially levelling the playing field for small businesses trading within the region. SMEs will no longer need to fork out extra money to have a payment arrive instantly, meaning that the decision of whether to make an international transaction via an instant service will no longer be a question of how much spare cash flow a business has. As a result, instant payments are likely to become the new norm, setting an example to other regions around the world and elevating the quality of transactions within the SEPA zone.

Helping deliver a better experience to SMEs

Across Europe, several countries have already implemented their own instant domestic payment systems to ensure that funds arrive on time. But for these systems to successfully work on an international level, interoperability between them is essential.

“The European regulation has the potential to be a landmark development for the cross-border payments industry,” said Marianne Demarchi, Chief Executive, EMEA, at Swift. “But financial institutions are under pressure to comply with the Verification of Payee element by the October 2025 deadline.

“Swift is ideally placed at the heart of the industry to facilitate interoperability of VoP schemes, simplifying the compliance process for our community and giving users of cross-border payments peace of mind when sending money not just across borders within Europe, but also beyond.”

To realise these benefits for SMEs, banks and other payment providers need a means to comply with the incoming changes. As a globally inclusive cooperative made up of 11,500 institutions, we can facilitate this through our Payment Pre-validation solution. This will allow financial institutions to repurpose their existing connectivity to securely transfer and verify financial data, which is essential to the success of Verification of Payee across Europe and can serve as an example to other regions too.