What’s in store for 2018?

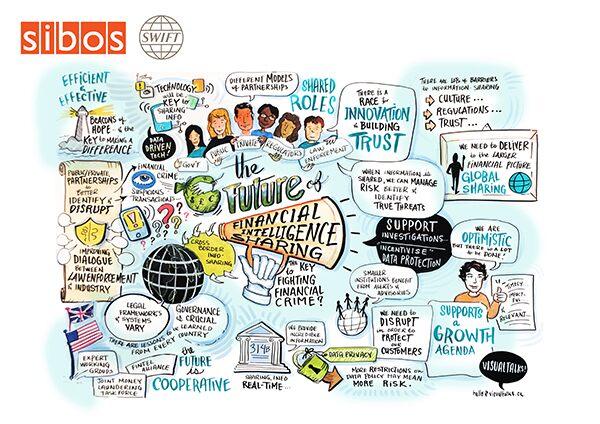

In 2018, partnership and collaboration will continue to be critical success factors in the fight against financial crime. To successfully tackle financial crime, the industry needs access to the right information. And banks need to work with each other, with regulators and law enforcement authorities to share financial intelligence and allow the effective investigation of criminal activities when they arise.

We’re already seeing the industry pulling together to design more robust and effective cybersecurity measures, as banks develop richer fraud control and monitoring environments to tackle cybercrime.

And a desire to improve the effectiveness and efficiency of banks’ financial compliance efforts was a resounding message heard across compliance stream sessions at Sibos 2017.

Supporting your compliance needs

Financial crime compliance continues to be a key priority and we are building on our portfolio to meet evolving industry needs, with an increasing focus on sanctions, analytics and fraud prevention solutions.

- Name Screening Batch: the addition of batch screening to Swift’s existing Name Screening service is a key development in the area of anti-money laundering checks

- Fraud detection: a real-time fraud detection capability, Payment Controls, will be launched mid-2018 as part of our Customer Security Programme

- Continued product upgrades are tailored to the needs of our community and helping to drive efficiency