Stop payments in flight and recall the funds quickly

When there’s a problem with a payment, being able to quickly stop it in its tracks is key to preventing fraudulent activity and the long series of investigations that comes with it.

For payment operations teams and your customers, the number one priority is reversing the damage as quickly as possible and getting the money back to its rightful owner.

Status of the service: live

Our solution

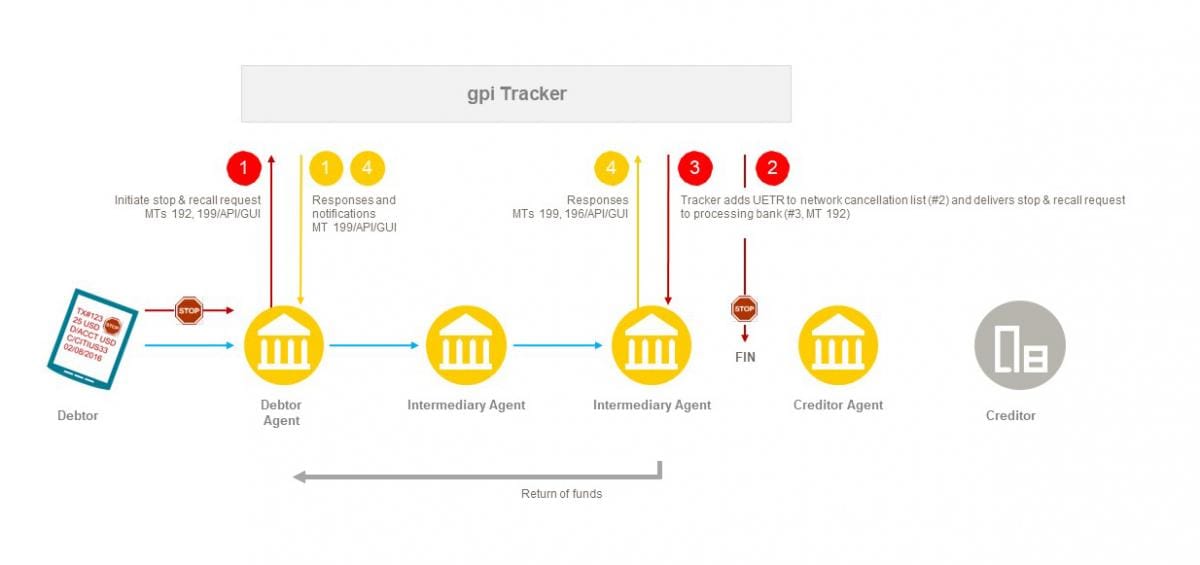

Stop and Recall is part of our Case Management portfolio, focusing on relieving financial institutions of the hassle that exceptions and investigations can bring. This service harnesses the power of the Swift GPI Tracker to enable you to rapidly halt payments and recall funds to the sender.

With this solution, you can initiate, deliver and respond to payment stop and recall requests automatically, leveraging the Tracker’s ability to monitor payments in real time. By automating this process, Stop and Recall has the potential to dramatically decrease the time, effort and cost spent on manual searches, as well as the workload associated with stopping a payment.

When you suspect a payment has been made in error or may be fraudulent, you can send a stop and recall request to the Tracker. An in-flight transaction will automatically be stopped via the network, preventing any further processing. The Tracker will also route the stop and recall request to the intermediary financial institution handling the payment at that moment. After stopping the payment, the institution can re-route the funds back to you before it’s too late.

Values and benefits

Enhance customer experience

Handling payments in the millions or even billions can be stressful. Your customers want to have peace of mind that if something goes wrong, it can be reversed before the funds are lost. By leveraging Stop and Recall, you can reassure your clients and foster better relationships.

Reduce manual intervention, increase transparency

When there’s a problem with a payment, your payment operations teams need to be fast and efficient. They shouldn’t have to engage in a series of manual interventions with your counterparties when time is critical. Stop and Recall makes interventions much more efficient and enables you to act fast by utilising real-time, on demand visibility on the progress of a stop request.

Combat fraud

The sophistication of fraudsters and cyber-criminals is growing. If you or a customer has been the victim of a fraudulent transaction, Stop and Recall enables you to act quickly and prevent fraudsters from getting away with your money.

Testimonials

Case Study - China Minsheng Bank and gpi Stop and Recall

Find out how China Minsheng Bank is delivering value-added services for its corporate customers using the...

Case Study - J.P. Morgan & Stop and Recall

Find out how J.P. Morgan is leveraging Swift’s stop and recall service to streamline and automate...

When can I sign up?

For gpi members

gpi customers can sign up and join our community of over 100 financial institutions already using the service.

For non-gpi members

Non-gpi banks subscribing to this service will have access to the whole Case Management portfolio, including both Case Resolution and Stop & Recall.

Have a question?

If you’d like to find out more about our Stop and Recall service, explore our FAQs or get in touch with your account manager.

Get started with Stop and Recall

Contact your account manager.