Today, 90% of cross-border payments sent over the Swift network reach destination banks within an hour. But more work must be done at the beneficiary leg of the journey in the receiving country to meet the G20’s end-to-end processing target for international payments, Swift network data shows.

As cross-border payment volumes continue to boom, there’s a major focus from the financial community, regulators and others to ensure transactions are as fast, frictionless, secure and equitable as possible.

To provide common goals for all to work towards, in 2020 the G20 set targets to enhance the speed, transparency, cost and accessibility of cross-border payments. With the deadline to meet these targets approaching in 2027, public and private sector stakeholders are rallying to the cause.

The speed target set by the G20 is to achieve end-to-end processing with funds credited to the end-customer’s account within one hour for 75% of cross-border payments. In recent years, the global financial community, together with Swift, has made great strides in enhancing the overall cross-border payments experience, including on speed. And the latest data from the Swift network reveals where in the overall journey payments are fast, and where more attention is needed.

Shining a spotlight on speed

The equivalent of the world’s GDP moves via the Swift network roughly every three days, and these transactions include tracking information for millions of international payments. Data from these transactions shows that international payments today travel quickly between the banks sending and receiving payments (‘in-flight processing time’). When delays occur, the data shows that it’s typically at the beneficiary leg due to factors in the receiving country that slow down the process between when the funds arrive at the end-customer’s bank and when they’re credited to their account (‘beneficiary-leg processing time’).

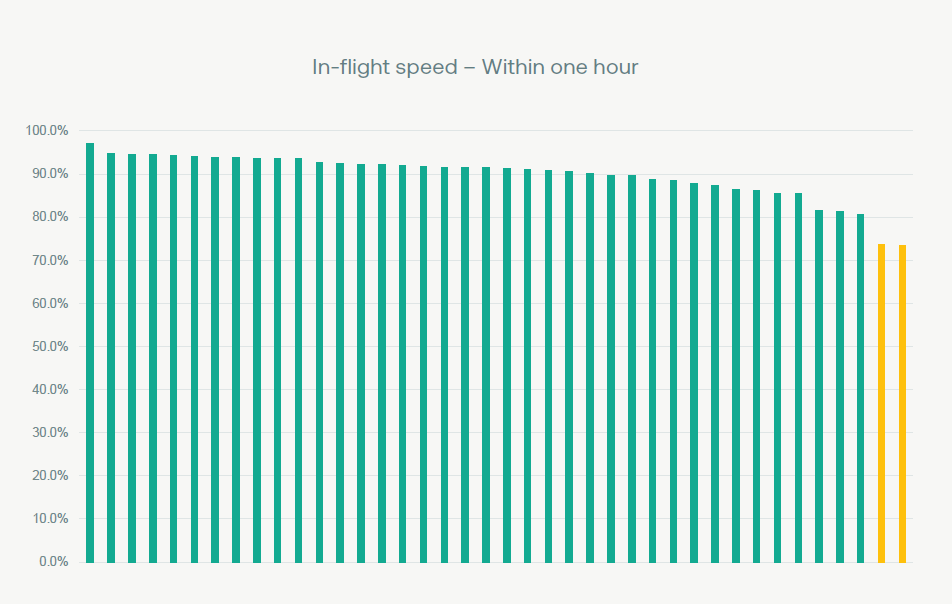

These findings are detailed in our new report, Spotlight on speed: Where to focus for faster international payments. It shows that today 90% of cross-border payments made over the Swift network reach beneficiary banks within an hour. And the speed of in-flight processing of transactions to all but two of the top 40 countries on our network, by volume of payments received, continues to be above the G20’s target.

Speed of payments over Swift to the beneficiary bank in top 40 receiving countries and territories.

“We’re very encouraged by how the global financial industry has united behind meeting the G20’s targets for enhancing cross-border payments, demonstrating the crucial role international transactions play in facilitating economic growth,” said Thierry Chilosi, Chief Business Officer at Swift.

“Significant improvements have been made in the areas of speed, access, transparency, and predictability, through our suite of friction-removing tools and services such as Swift GPI and Payment Pre-validation.”

What’s more, Swift data shows that very few international payments on our network pass through long chains of intermediaries before arriving at their destination. 86% of all payments are conducted directly or with a single intermediary. And as most intermediaries have streamlined their processes, the role of intermediaries in the payments process typically adds little time to a payment’s journey.

Tackling the last leg

While in-flight processing times between originating and destination banks has significantly accelerated, the data reveals that more work is needed at the beneficiary leg of a payment’s journey to achieve the G20’s end-to-end speed target.

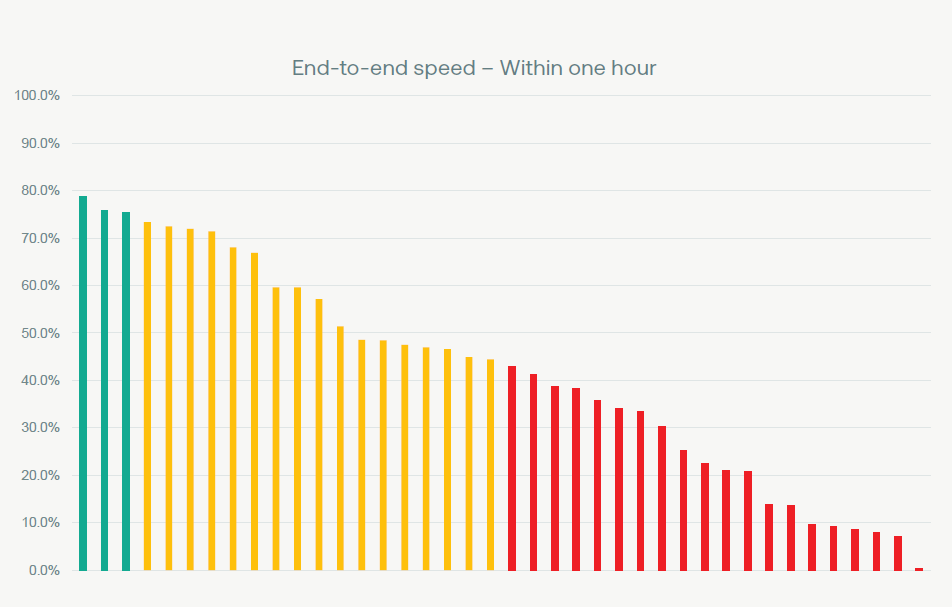

Currently there is a wide variation between processing speeds at the domestic stage of a transaction among the top 40 countries. As a result, globally 43% of cross-border payments are currently processed end to end in under an hour.

“We’re committed to continuing to collaborate with our community to create a fast, trusted, and secure end-to-end cross-border payments experience,” says Chilosi. “To really push on and achieve the G20’s goals, it’s vital that the industry and global policymakers’ efforts are focused firmly on the domestic beneficiary leg of transactions, so that an enhanced experience can be enjoyed by every customer.”

Speed of payments to the end-customer’s account in the top 40 receiving countries and territories on Swift.

What factors contribute to speed?

Countries with higher processing speeds that are already meeting the G20’s end-to-end speed target have developed real-time systems, with most banks operating 24/7 real-time back offices and with no significant currency or capital controls on incoming payments.

For countries that are experiencing continued delays, there are a variety of possible causes for reduced speeds. In some cases, there are differences in the speed of institutions crediting the clients or updating the tracking information, which may be the result of batch processing in back-office systems. Other factors include market infrastructure opening hours, regulatory requirements, or local market practices, such as the need to check with the customer that a payment is expected or confirm the final amount.

Swift does not take a position on the necessity of these checks, nor do we have an overview of the precise details of the reasons for the speed variation by country. However, what our report aims to show are the factors that can impact the speed of international payments so that mitigating action can be identified and taken, if desired.

Building an instant, frictionless and interoperable financial future

Collaboration is key to enhancing global payments. This is also central to our mission to enable instant, frictionless and interoperable international transactions, for today and the future.

International payments have improved significantly in recent years as a result of initiatives like the G20’s roadmap, Swift GPI, and others that are driving progress.

But while improvements can and are still being made during the payment’s journey to the end-customer’s bank, these are unlikely to make a big difference to achieving the G20’s end-to-end speed target, as the in-flight part of the payment journey is already near or significantly higher than the target.

Where action is needed now is at the beneficiary leg in receiving countries to ensure end customers receive the money on their accounts in line with the G20’s target.

Download the full report

Read our report ‘Spotlight on speed: Where to focus for faster international payments’ to learn more.