Swift Securities View

Swift Securities View enhances settlement efficiency by providing end-to-end tracking of securities settlement transactions. Leveraging the Unique Transaction Identifier (UTI), an ISO standard, it links all related Swift messages, ensuring end-to-end transparency on the two-sided settlement flow and quick exception detection. This proactive approach identifies potential issues earlier, minimises settlement fails, reduces operational risk, and boosts processing efficiency. This is in line with our commitment to operational excellence.

Benefits

Key Features of Swift Securities View

-

The Unique Transaction Identifier (UTI)

Swift Securities View leverages the Unique Transaction Identifier (UTI) - an ISO standard - to streamline the settlement process. This 52 character ISO- standardised identifier unambiguously identifies a transaction obligation in post-trade settlement

It is generated either on a central trade matching and/or confirmation platform, or between a buyer and a seller for bilateral trades.

Once generated, the UTI is consistently referenced by all parties involved in the transaction, across the entire settlement chain.

-

Swift Securities Tracker

The Swift Securities Tracker is a securities tracking database hosted at Swift.

It collects, extracts, interlinks and compares (thanks to the UTI) the key transaction data from the securities messages exchanged between service participants to visualise the end-to-end transaction data in a GUI and/or to shares it via API and MT based notifications with the service participants.

-

A Rulebook

The business rules and specifications for Swift Securities View are documented in a rulebook. It outlines the technical, operational and business rules and guidelines in place in Swift Securities View.

FAQs

How it works

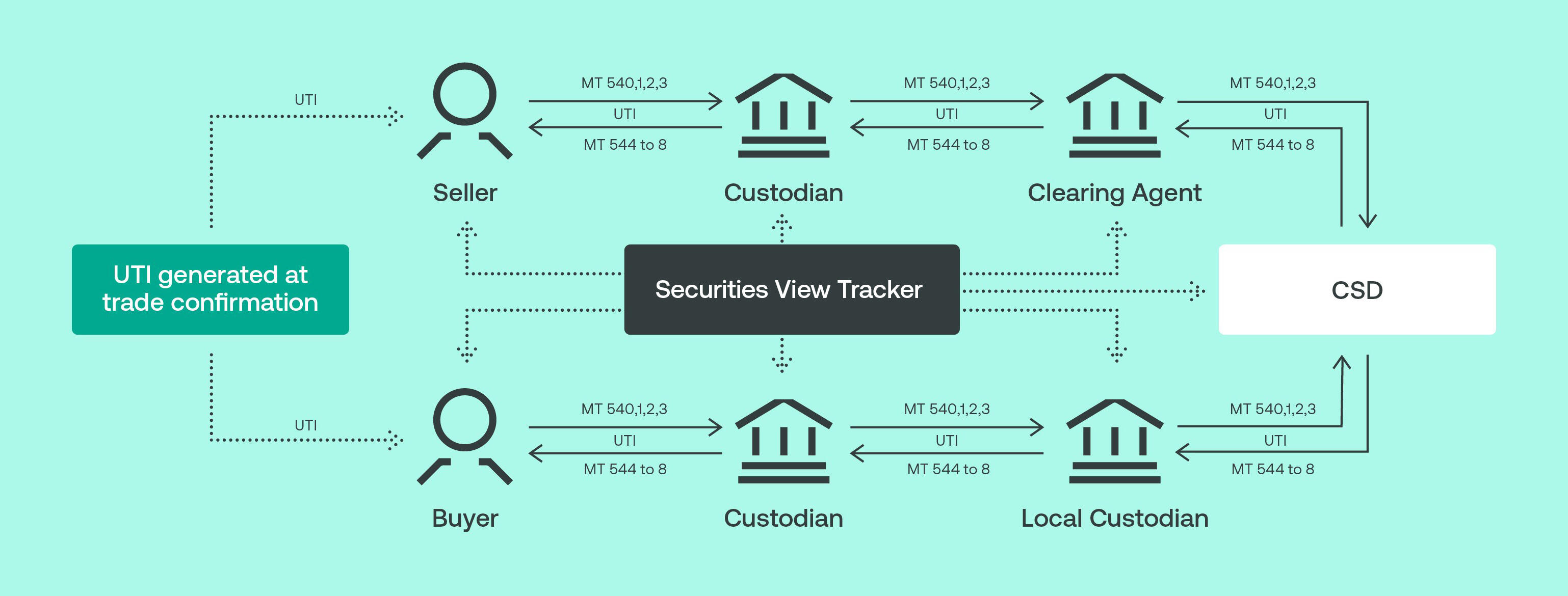

Swift Securities View gives you the data and tools you need to improve visibility and understanding of your securities settlement transactions. It leverages the settlement data carried in ISO 15022 MT messages, including a Unique Transaction Identifier.

The service provides an early warning of issues that today are typically detected later in the settlement chain, such as discrepancies between buy and sell instructions or if a counterparty’s instruction is missing.

You can access Swift Securities View through a GUI or integrate it into your back-office systems and client portals using multiple channels including API and MT notifications.

1/ A UTI is generated and assigned to a securities trade, as part of the trade allocation or confirmation process between a buyer and a seller. This could be over a centralised trading venue, matching platform, or by an instructing party in the case of a bilateral trade.

2/ Buyer and seller include the UTI in their Swift settlement instruction to their respective custodians.

3/ The custodian(s) receive, process, and persist the same UTI in their outgoing transfers to their next agent(s) or CSD.

4/ All parties continue to process and persist the UTI in all related Swift settlement messages.

5/ Thanks to the UTI, the Securities View Tracker provides tracking, comparison, and alerting information at every step of the flow (from initiation, (un)matching, cancellation, partial settlement, settlement) to all parties involved.

Who’s using Swift Securities View?

The service was developed in collaboration with our community and counts participants from all stages in the settlement process among its active members – including asset managers, outsourcers, brokers, global and sub custodians, CSDs.

- ABN AMRO Clearing Bank

- ABSA Bank

- Ahadu Bank

- Ardshinbank

- Banca del Ceresio

- Banco De Sabadell

- Banco Nacional De Costa Rica

- Bangkok Bank

- Bank Vontobel

- Banque et Caisse d'Épargne de l'État

- Barrenjoey Markets

- Ceca Bank

- Central Bank of the Republic of Azerbaijan

- Central Latinoamericana de Valores

- Challenger Group Services

- China Construction Bank

- DBS Bank

- Everbright Bank of China

- Hwatai Bank

- Irishi Life Investment Managers

- Julius Baer

- Korea Securities Finance

- Macquarie Bank

- Mizuho Securities (Asia)

- National Investment Bank of Mongolia

- NH Amundi Asset Management

- Nordea Bank

- Okasan Securities

- Pancreta Bank

- PT Bank CIMB Niaga

- Samsung Asset Management

- SBI Shinsei International

- Sculptor Capital

- Shinhan Securities

- Societe Generale

- Sparkasse Bank Malta

- Standard Chartered Bank

- UniCredit Bank Slovenija d.d.

- Wood and Organisation

How to start implementing the UTI?

The Unique Transaction Identifier (UTI) is a unique 52-character alphanumeric code that is already used for securities financial transaction reporting.

The generation and initial exchange of a UTI value occurs as part of the trade allocation, confirmation, and affirmation process between the buyer and seller. UTI values are generated by the allocating entity (if manual bilateral trade) or by the electronic platform that facilitate the allocation and confirmation process between an instructing party and their executing counterparty. Subsequent communication of a UTI and onward exchange continues through the settlement life cycle between account owners and account servicers.

For full details on the UTI generation and communication, please download and consult the “Market Guidelines and Implementation Summary” document available on this page

Who generates the UTI and how is it communicated?

The recommendation for generation of the UTI follows existing IOSCO, ESMA, and ISDA guidelines.

UTI generation and communication should occur at the earliest possible point in the trade flow. The market guideline is that the generation and initial exchange of a UTI value occurs as part of the trade allocation, confirmation, and affirmation process between the buyer and seller. UTI values are generated by the allocating entity (if manual bilateral trade) or by the electronic platform that facilitates the allocation and confirmation process between an instructing party and their executing counterparty. Subsequent communication of a UTI and onward exchange continues through the settlement life cycle between account owners and account servicers.

For further details on the UTI generation and communication, please consult the “Market Guidelines and Implementation Summary” document, available here

Which securities settlement and reconciliation messages (MT or MX) are supported by Swift Securities View?

Within the financial services industry, multiple messaging standards are used. The scope of the Swift Securities View service includes settlement message activity based on the ISO 15022 securities settlement (MT) messages.

Changes to the service scope, such as supporting additional messaging standards and data sources are evaluated and prioritised with the service community, and steering groups. Current status is to monitor the usage of ISO20022 (MX) for securities, in particular adoption by Financial Market Infrastructures (FMI) or regional markets. Once a market or FMI confirms adoption, supporting settlement message activity based on ISO 20022 messages will be prioritised for a future release.

What system modifications are required within a securities firm to support the universal transaction identifier (UTI)

The UTI field was added as an optional field to all securities settlement and reconciliation MT and MX messages as part of the Swift Standards Release 2019.

If a securities firm would like to adopt the UTI, additional system developments will be required within their organisation in order to functionally support the identifier in the securities settlement lifecycle. Organisations will be required to populate and receive UTI values on inbound and outbound messages, as well as persist these values downstream on corresponding instructions as well as upstream on status response messages.

In case your organisation has a third-party securities settlement application in house, the third party provider takes care of the UTI integration in his application. To find out which applications and providers already support the UTI, click here

What are the message fields catering for a Unique Transaction Identifier (UTI) in the Swift securities settlement and reconciliation messages?

The 52 characters UTI is already available to you as an optional field in the securities settlement and reconciliation MT and MX messages concerned.

You can find the fields in:

MT - ISO15020 – messages

- Field 20a: Reference in subsequence A1 Option U :4!c//52x Qualifier TRRF (:20U::TRRF).

MX - ISO20022 – messages

Field Trade Identification <TradId> under Trade details <TradDtls>

Do note that a dedicated UTI field will be introduced in the MX – ISO20022 – messages in November 2025 over Standards Release SR2025.

Which asset classes does Swift Securities View support?

The service coverage is founded on the Swift settlement and reconciliation (MT540-8) messages and the asset classes used by these messages. The majority of transactions are associated with trade purchases and sells, with smaller volumes associated with securities financing, funds and clearing flows.

What are the rules for UTI consumption and communication in Swift Securities View ?

Organisations are expected to support the receipt & sending of UTI values within their securities settlement workflows that utilise Swift MT540 to MT548 messages.

- Users acting as ‘account owners’ sending instruction messages to their ‘account servicers’ are required to:

- Populate a UTI: include a UTI value in field 20U of a Swift settlement instruction when there is counterparty agreement on a trade confirmation process that provided a UTI value

- Maintain a UTI: populate the same UTI value for cancel and re-book amendments and version changes and applicable lifecycle events for a transaction; cancellation, cancel/replace, split or partial settlement

- Persist the UTI: copy the same UTI value when instructing onward delivery or receipt for a received instruction

- Users acting as ‘account servicers’ receiving instruction messages from their ‘account owners’ and sending status and confirmation messages to their ‘account owners’ are required to

- Consume the UTI: parse and store the UTI value if present on a received instruction message

- Echo the UTI: copy the same UTI value on status (including confirmation) messages sent for the received instruction

- Persist the UTI: copy the same UTI value when instructing onward delivery or receipt for a received instruction

Which communication channels are available to take advantage of Swift Securities View?

When signed up for Swift Securities View, you can access the Swift Securities Tracker through 3 communication channels:

- A Graphical User Interface (GUI): This enables your operators to search, view, track, compare and export from the Securities Tracker database all end-to-end transactions in which your organisation is a settlement party.

- API notifications: This channel enables your back-office systems to query the Securities Tracker database for the latest status or details of securities transactions with a UTI in which your organisation is a settlement party.

- MT notifications: A specific user-to-tracker MT (MT548) enables your back-office systems to query the Securities Tracker database for the latest status or details of securities transactions with a UTI in which your organisation is a settlement party.

How is the UTI generated and communicated in case of non-electronic trades?

For securities settlement workflows without an allocation/confirmation platform (i.e., in a bilateral exchange process) or for platforms that do not support UTI generation, the instructing party or their service provider should generate the UTI and share the value as part of the allocation process with the executing counterparty.

For further details on the UTI generation and communication, please consult the “Market Guidelines and Implementation Summary” document, available here

Who’s already signed up and using Swift Securities View?

Over 150 participants from all stages in the settlement process have signed up for the service, including asset managers, brokers, global and sub-custodians, buy- and sell-side outsourcers, Central Securities Depositories and more.

Find out who already joined on swift.com or via your Swift relationship manager.

How to get started with Securities View?

-

Watch the demo

-

Speak to an expert

-

Developer Portal

Discover the Swift Securities View APIs services.

Go to the Developer Portal -

Ready to start?

Subscribe to Swift Securities View now.

Resources

Learn more about Swift Securities View

Testimonials

-

Swift Securities View brings the much needed transparency to post-trade securities. As an asset manager, we face more pressure than ever to avoid trade fails. This is due to shortening settlement cycles globally and financial penalties for late settlement imposed by CSDR. With the end-to-end visibility provided by Swift Securities View, we’re able to minimise the risk of fails and improve operational efficiency. We encourage all market participants to join and share in these benefits.

-

We believe the introduction of UTI and Securities View will provide participants with greater transparency into the status of securities settlement transactions. This is of increasing importance to Northern Trust and our clients as we prepare for compressed settlement cycles with less time to identify and resolve trade exceptions. Securities View will also provide greater insight into points of friction across the post-trade lifecycle, resulting in improved operational efficiency and reduction in late settlements.

-

Swift Securities View does more than just empower our customers to identify and rectify discrepancies in settlement transactions. It sets the blueprint and foundation for a new industry standard to radically transform the industry.

-

Having already implemented Swift GPI, we are delighted to participate in the program’s extension to Securities View, and eagerly anticipate broader industry adoption of this service to further enhance settlement efficiency.